Introduction:

In the fast-paced world of small business, effective financial management is crucial for success. Small business owners often face the challenge of balancing multiple responsibilities, and manual bookkeeping can be time-consuming and prone to errors.

In this blog post, we will explore the numerous benefits that cloud-based accounting software offers to small businesses, revolutionizing their financial management processes.

Streamlined Accessibility and Mobility:

One of the key advantages of cloud-based accounting software for small businesses is its accessibility. With traditional accounting systems, you are often tied to a specific device or location. Cloud-based software allows you to access your financial data from anywhere with an internet connection.

Whether you’re at the office, on a business trip, or even at home, you can easily view your financial records, update transactions, and monitor cash flow. This mobility empowers small business owners to stay informed and make important financial decisions on the go.

Real-Time Collaboration and Multi-User Access:

Cloud-based accounting software enables seamless collaboration among team members, accountants, and business owners. Multiple users can access the software simultaneously, eliminating the need for file sharing or manual updates.

This real-time collaboration streamlines communication and ensures that everyone has access to the most up-to-date financial information. For example, a small business owner can grant their accountant access to relevant financial data, allowing them to provide timely advice and assistance without the hassle of exchanging files back and forth.

Automated Data Backup and Security:

Data loss can be catastrophic for any business, especially for small businesses with limited resources for recovery. Cloud-based accounting software takes care of data backup automatically. Your financial data is securely stored in the cloud, protecting it from physical damage or hardware failures.

Additionally, reputable cloud providers employ advanced security measures to safeguard your sensitive financial information, including encryption and robust access controls. With cloud-based accounting software, you can have peace of mind knowing that your data is secure and backed up regularly.

Scalability and Cost Efficiency:

Small businesses often experience fluctuating needs as they grow and evolve. Traditional accounting software may require costly upgrades or license fees to accommodate increased usage or additional features. Cloud-based accounting software offers scalability, allowing you to scale up or down as per your requirements.

You can easily add or remove users, access additional storage space, and integrate new functionalities without major upfront investments. This scalability ensures that your accounting software can adapt to your business’s changing needs, providing a cost-effective solution for small business owners.

Integrations and Time-Saving Features:

Cloud-based accounting software often integrates with a variety of third-party applications, such as payment processors, inventory management systems, and customer relationship management (CRM) tools. These integrations automate data synchronization, eliminating manual data entry and saving you valuable time.

For example, when a sale is made through your online store, the cloud-based accounting software can automatically update your sales records, adjust inventory levels, and generate invoices. These time-saving features reduce manual errors, improve efficiency, and allow you to focus on growing your business.

Conclusion:

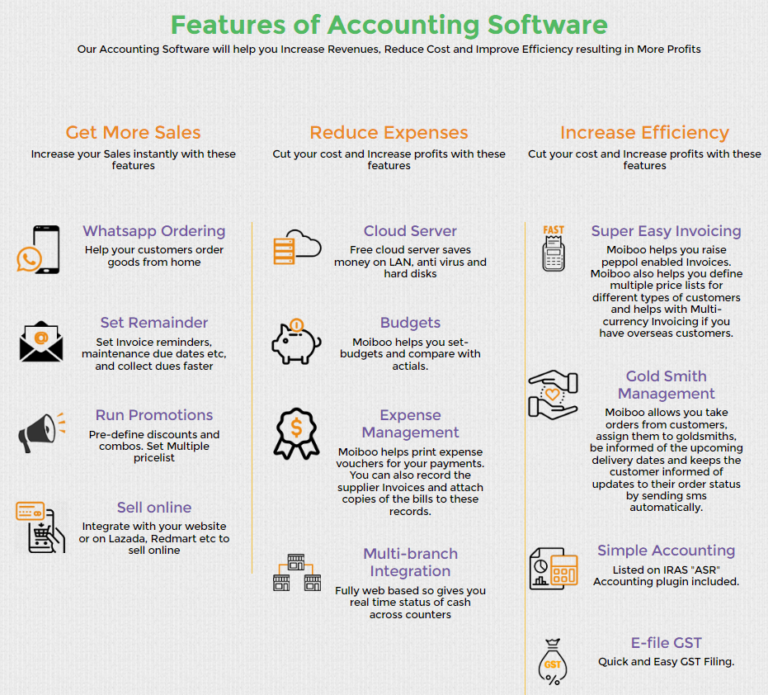

In conclusion, cloud-based accounting software provides significant benefits for small businesses. The accessibility, real-time collaboration, automated data backup, scalability, cost efficiency, and time-saving features make it an invaluable tool for managing finances effectively.

By embracing cloud-based accounting software, small business owners can streamline their financial processes, make informed decisions, and ultimately drive success in their ventures. Invest in the right cloud-based accounting software and witness the transformative power it can bring to your small business.

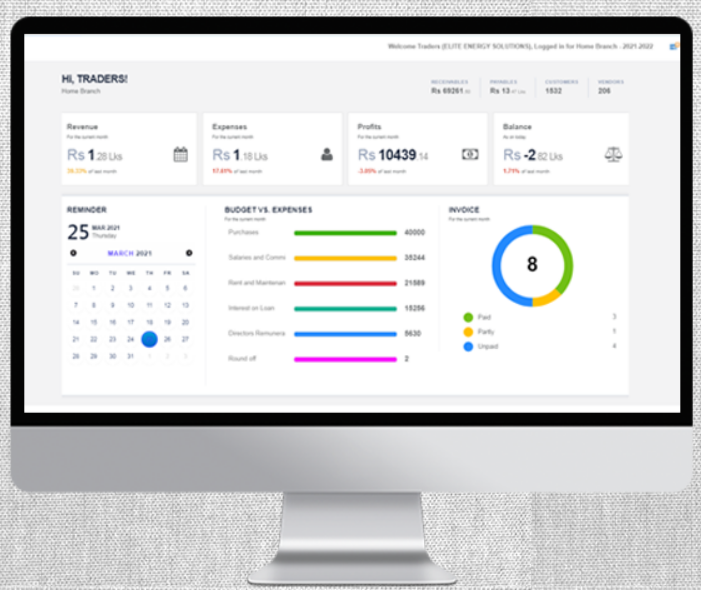

For small businesses seeking a reliable and efficient accounting software solution, we wholeheartedly recommend giving our comprehensive software a try. Our solution is specifically designed to streamline your business operations and enhance your financial management processes.

By clicking on the provided link, you can access a free demo of our services, allowing you to experience firsthand the multitude of benefits our software offers. or you can call and book the free demo at +65 9895 1817.

FAQS:

What does the accounting software do for a small business?

Accounting software for a small business is a powerful tool that automates and simplifies various financial tasks.

It helps in managing bookkeeping by recording and organizing financial transactions, maintaining general ledgers, and tracking income and expenses. Additionally, it facilitates invoicing and billing processes by generating professional invoices, tracking payments, and sending reminders for outstanding payments.

It also provides features like bank reconciliation, financial reporting, tax calculations, and inventory management, allowing small business owners to efficiently manage their finances, make informed decisions, and maintain accurate financial records.

Overall, accounting software for small businesses streamlines financial management, saves time, reduces errors, and provides valuable insights into the business’s financial health.

What are the types of accounting software?

Accounting software can be categorized into several types based on its functionality and target audience. Some common types include general accounting software, which offers core accounting features like bookkeeping, invoicing, financial reporting, and inventory management.

There is also industry-specific accounting software designed for sectors like retail, construction, hospitality, and healthcare, providing specialized features tailored to the needs of those industries. Additionally, there are enterprise resource planning (ERP) systems that integrate various business functions, including accounting, into a unified platform.

Another type is tax preparation software, which helps individuals and businesses calculate and file their taxes accurately. Furthermore, there are free or open-source accounting software options available, providing basic accounting features at no cost.

Finally, cloud-based accounting software has gained popularity due to its accessibility, mobility, and collaboration features. Businesses can choose the type of accounting software that aligns with their specific needs, industry requirements, and budget.

How do I start accounting for a new business?

When starting accounting for a new business, there are several key steps to follow. Begin by setting up a separate business bank account to keep personal and business finances separate.

Choose an accounting method, either cash or accrual, to track income and expenses. Select and implement accounting software that suits your business needs. Create a chart of accounts to categorize income, expenses, assets, and liabilities. Set up a system for organizing and storing financial documents, such as receipts and invoices.

Establish a schedule for regular bookkeeping tasks, such as recording transactions, reconciling accounts, and preparing financial statements. Finally, consider seeking professional advice from an accountant or bookkeeper to ensure compliance with tax regulations and to gain valuable insights into your business’s financial health.