Singapore is a business-friendly system due to the Government grants and incentives available for companies to grow their business.

How the Government Grants Help Businesses in Singapore?

The grants and schemes help businesses in Singapore by providing funding for various aspects of business development, such as improving productivity, upgrading capabilities, and expanding overseas. The government’s support allows businesses to grow and innovate, helping to drive Singapore’s economy forward.

There are six major grants and incentives that the companies can opt for;

1. Productivity Solutions Grant

Productivity Solutions Grant came into effect in April 2018. The PSG grants funds for qualifying activities under the retail, food, logistics, Engineering, wholesale, Construction, Landscaping, etc.

It is used by businesses to support the use of solutions in financial management, inventory tracking, customer management, data analytics, etc.

The PSG grant supports small businesses by making funds available to them for upgrading their business.

2. Enterprise Development Grant

- This grant supports the Singapore business in the areas of

- Market and business development

- Innovation and productivity

- Core functions and capability

To qualify the business must be a local company registered in Singapore having at least 30% of the local shareholding and having an annual turnover of $100 Million or having at least 200 employees.

This grant helps new businesses explore innovative production. It helps in making the business a profitable venture, it helps the business enjoy higher savings during the first few years of its establishment.

3. PACT

This Grant aims at enhancing collaboration between large multinationals and local companies. This grant encourages small and medium-sized businesses to partner with each other to facilitate business innovation and growth. The grant funds are for SMEs and non-SMEs.

Companies need not restrict themselves. Small businesses can benefit from the networking and experience of the larger companies.

The larger companies that act as the lead companies need to be registered in Singapore and the smaller companies can be either local or foreign companies.

4. Double Tax Deduction for Internationalization

It encourages businesses to move towards international expansion and internationalization. The businesses are entitled to a 200% tax deduction up to $150,000 on expenses for these activities.

The activities are limited to the following;

- Overseas business trips

- Overseas trade fairs

- Market surveys

- Investment Feasibility

- Expenses of Singaporean staff.

This grant helps to reduce the tax burden of the companies and makes the businesses more money in their hands.

5. Market Readiness Assistance Grant

This Grant was established to access overseas opportunities.

It helps in the following areas;

- Market set up overseas.

- Identifying partners, licenses, agents, etc.

- Market promotion

The headquarters of the company should be in Singapore with an annual turnover of 100 million or 200 employees.

It helps the business to expand internationally.

6. Venture Debt Programme

These government grants help companies to access loans for project financing, asset financing, and acquisition purposes. This grant helps the business to set up and expand their business. This grant was initiated for small Singaporean businesses to be eligible for a loan. The requirement is 30% local ownership and less than 200 employees.

Conclusion

The grants and incentives provided by the Government make Singapore a business-friendly regime. The new grants are targeted toward the specific needs of Singapore businesses. These grants are aimed at encouraging innovation, boosting productivity, and expanding businesses’ capabilities.

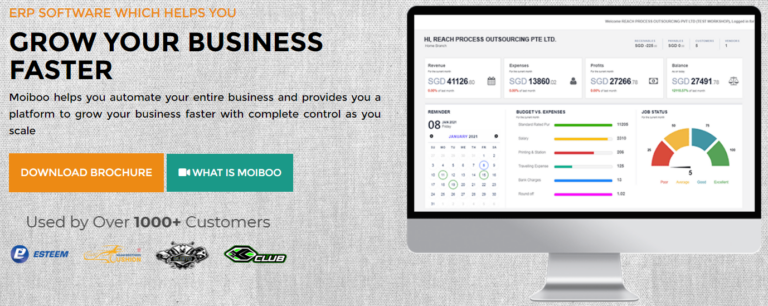

If you are looking for PSG Grant pre-approved Automation software for your business we recommend you try our Moiboo automation business software to automate your entire business end-to-end., click here for the free demo or Please feel free to call for more details: +65 9895 1817

Note: Please note that the information provided is subject to change periodically. It is important to check for the latest updates and eligibility criteria for government grants and support schemes available in Singapore.

FAQS:

What is the government grant for startups in Singapore

The Singapore government provides various grants and funding schemes for startups to support their growth and development. Here are some of the grants available for startups in Singapore: 1. Startup SG Founder, 2. Startup SG Equity, 3. Enterprise Development Grant (EDG), 4. Productivity Solutions Grant (PSG). It is essential to check the eligibility criteria and requirements for each grant before applying.

What is PSG grant Singapore?

The Productivity Solutions Grant (PSG) is a grant provided by the Singapore government to support businesses in adopting technology solutions to improve productivity and efficiency. The PSG is available to all businesses, including Small and Medium Enterprises (SMEs), in Singapore across various industries.

What are the benefits of the PSG grant?

The PSG grant provides businesses with financial support and access to technology solutions that can help them improve productivity, enhance competitiveness, and prepare for the future. Here are some benefits of the PSG grant: Financial support, Improved productivity, Enhanced competitiveness, Access to new markets, and Increased digital readiness.

How can I start a business in Singapore with no capital?

Starting a business in Singapore without capital can be challenging, but it is possible to do so with some careful planning and creative thinking.

Here are some steps that can help you start a business in Singapore with no capital: Choose a business idea, Create a business plan, Leverage your network, and Seek government grants and support schemes, Starting a business in Singapore with no capital requires creativity, resourcefulness, and persistence.