Introduction.

Choosing the right accounting software is a critical decision for businesses of all sizes. It can streamline financial processes, improve accuracy, and provide valuable insights into your business’s financial health.

However, with numerous options available, it’s important to consider several essential factors before making a decision. In this blog, we will discuss the ten crucial factors you should consider when choosing accounting software for your business.

Scalability.

One of the first factors to consider is the scalability of the accounting software. As your business expands, your accounting requirements will also increase. Ensure that the software can accommodate your current size and has the capacity to handle increased transaction volumes, additional users, and expanding data requirements.

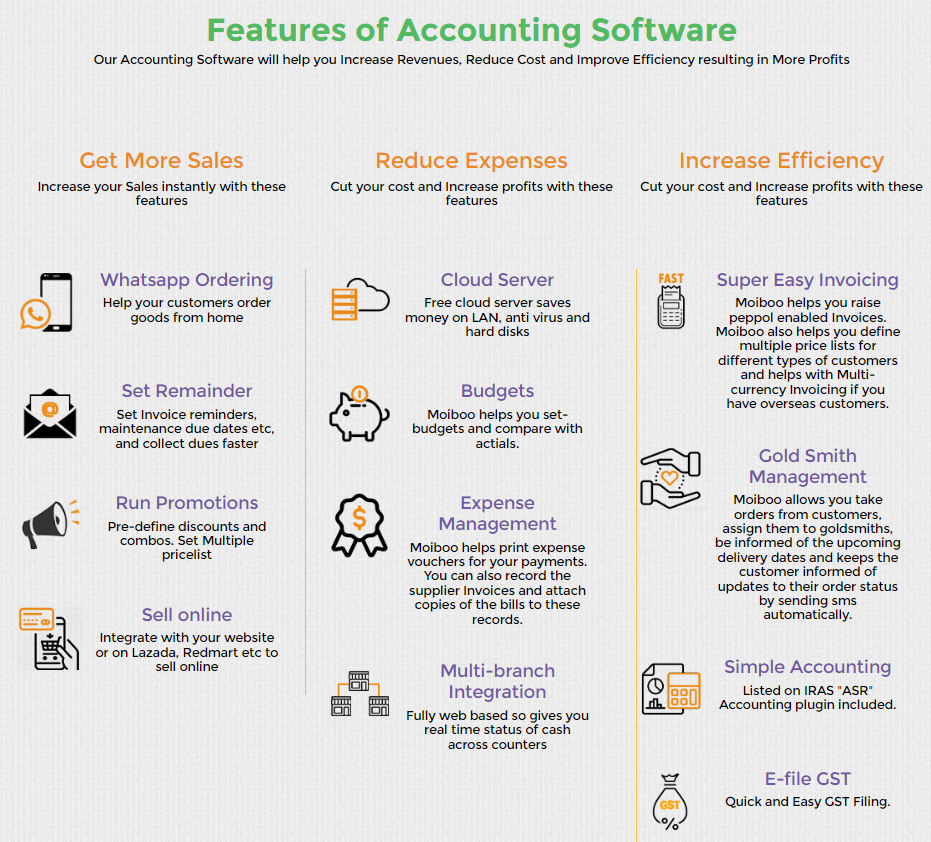

Features and Functionality.

Evaluate the features and functionalities offered by the accounting software. Consider the specific accounting needs of your business, such as invoicing, expense tracking, inventory management, payroll processing, tax management, and financial reporting. Ensure that the software provides all the necessary features to meet your requirements.

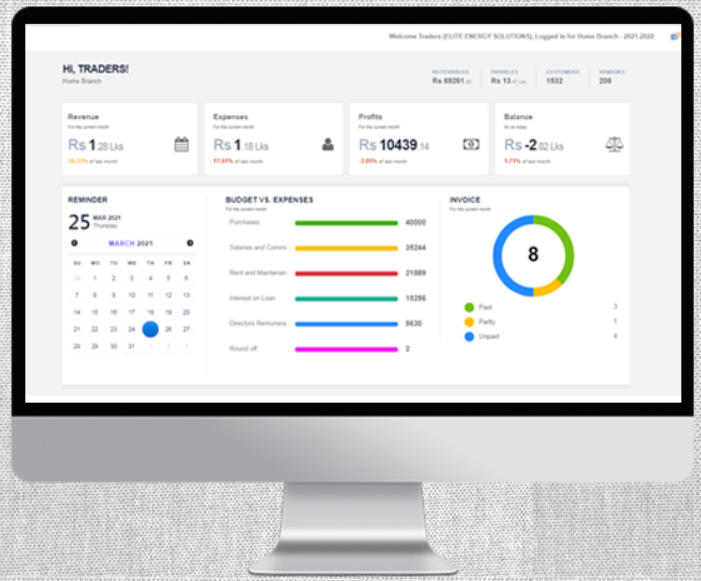

User-Friendliness.

A user-friendly interface is crucial for efficient usage and reducing training time for your staff. Look for accounting software that is intuitive and easy to navigate. Consider the ease of performing common tasks, entering data, generating reports, and accessing key financial information. A user-friendly software will streamline your accounting processes and minimize errors caused by user confusion.

Integration Capability.

Consider the integration capability of the accounting software with other essential systems you use in your business. Integration with tools like customer relationship management (CRM) software, payment processors, or e-commerce platforms can significantly streamline your operations by automating data flow between systems. By doing so, you can minimize the need for manual data entry and mitigate the potential for errors.

Cloud-Based or On-Premises.

Decide whether you prefer a cloud-based accounting software or an on-premises solution. Cloud-based software offers the advantage of accessibility from anywhere, automatic updates, and data backup. On the other hand, on-premises software provides more control and customization options but requires dedicated infrastructure and maintenance.

Security and Data Protection.

The security of your financial data is paramount. Ensure that the accounting software provides robust security measures, such as data encryption, regular backups, and access controls. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is also crucial to protect sensitive financial information.

Support and Training.

Evaluate the level of support and training offered by the software vendor. Look for resources like user guides, tutorials, online forums, and responsive customer support. Adequate support and training will help your staff become proficient in using the software effectively and address any issues that may arise promptly.

Cost and Value.

Evaluate the cost and value of the accounting software. Consider factors such as licensing fees, subscription plans, additional costs for add-ons or upgrades, and the value the software provides in terms of its features and functionalities. It’s important to find a balance between affordability and the value the software brings to your business.

Reporting and Analytics.

The ability to generate comprehensive reports and gain valuable insights from your financial data is crucial. Seek accounting software that provides extensive reporting and analytics features. It should allow you to generate financial statements, track key performance indicators (KPIs), and analyze trends to make informed business decisions.

Reputation and Reviews.

Lastly, research the reputation of the software vendor and read reviews from other businesses that have used the software. Consider feedback on reliability, customer support, ease of use, and overall satisfaction. Pay attention to reviews from businesses in similar industries or with comparable

Conclusion.

Choosing the right accounting software for your business is a decision that should not be taken lightly. By considering the ten essential factors discussed in this blog, you can make an informed decision that aligns with your business’s specific needs.

Remember to assess scalability, features and functionality, user-friendliness, integration capability, cloud-based or on-premises options, security and data protection, support and training, cost and value, reporting and analytics, and reputation and reviews.

Taking the time to evaluate these factors will ensure that the accounting software you choose streamlines your financial processes, enhances accuracy, and contributes to the overall success of your business.

For businesses in need of accounting software, we highly recommend trying out our comprehensive solution designed to streamline your business operations. Experience the benefits firsthand by clicking here for a free demo of our services. If you have any questions or need further information, please feel free to reach out to us at +65 9895 1817.

FAQS:

What is the difference of ERP and accounting software?

While accounting software focuses specifically on financial management tasks such as bookkeeping, invoicing, and financial reporting, an Enterprise Resource Planning (ERP) system is a comprehensive solution that integrates various business functions, including accounting, inventory management, supply chain, human resources, and customer relationship management.

ERP software provides a more holistic view of business operations, facilitating data sharing and streamlining processes across departments, making it suitable for larger organizations with complex operational needs.

Benefits of accounting software?

Accounting software provides benefits such as streamlined financial processes, accurate record-keeping, efficient reporting and analysis, simplified tax compliance, improved decision-making with real-time insights, and enhanced data security, ultimately leading to increased efficiency and financial management effectiveness for businesses.

Do accountants use QuickBooks or Excel?

Accountants commonly use both Excel and QuickBooks in their work. Excel is a versatile tool for data analysis, creating financial models, and performing complex calculations. It allows for customization and flexibility. QuickBooks,

on the other hand, is specifically designed for accounting tasks, such as bookkeeping, invoicing, and financial reporting. It provides dedicated features and functionalities tailored to the needs of accountants, making it a popular choice for managing day-to-day financial activities.

Accountants often utilize a combination of Excel and QuickBooks to leverage the strengths of both platforms.

How do I choose the best accounting software?

To choose the best accounting software for your needs, consider factors such as scalability, features, user-friendliness, integration capabilities, security, support, cost, reporting and analytics, and reputation.

Evaluate how well the software aligns with your business requirements, offers necessary functionalities, and provides a positive user experience, while also considering factors like data protection, customer support, and overall value for your investment.