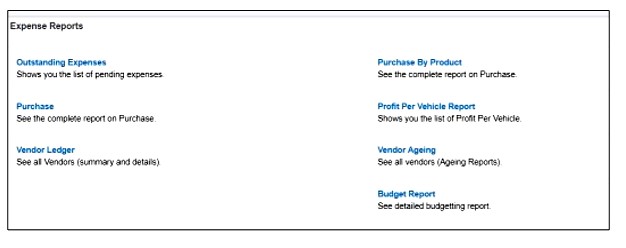

Expense Reports

An expense is a cost that businesses incur in running their operations. Expenses are deducted from revenue to arrive at profits. Details provided on the expense report include the date paid, vendor name, the amount paid, expense description, and totals for each expense category.

- Outstanding Expenses – An Outstanding Expense is a type of expense that is due but has not been paid. This expense becomes outstanding to the company when, the related payment has not been made. Examples for Outstanding Expenses – Rent due but not yet paid.

- Purchase – Displays a list of the vendors that your company has purchased items from within a selected period. It shows invoiced quantity, amount, and discount. The report can be used to analyse a company’s item purchases.

- Vendor Ledger – Vendor Ledgers lists vendors detail transaction information as well as outstanding balances per vendor. The Statement Of Accounts of the vendors can be seen here.

- Purchase By Product – A Product purchase report provides you an insight into the purchases made for various items in your inventory focusing mainly on quantity and total cost incurred to buy that quantity for a preferred date range.

- Profit Per Vehicle Report – The report shows the expenses incurred by the vehicle and the profit incurred by a particular vehicle.

- Vendor Ageing – The Vendor ageing report shows the customer balance based on ageing.

- Budget Report -A budget report is a financial picture of a business or project over a specific period. It collects data related to actual spending and compares that to what’s been projected for that period in terms of the budget.