GST Report

Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods (collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore.

Under the GST regime, regular businesses having more than Rs.5 crore as annual aggregate turnover must file two monthly returns and one annual return. This amounts to 25 returns each year.

GST FORM -5 – GST Form 5 is a document containing the taxpayer’s GST details required to file to the tax authorities. Business owners must file GST returns, including sales, purchases, GST on sales, and GST paid on purchases. It’s compulsory to file a GST Return form under GST regulations.

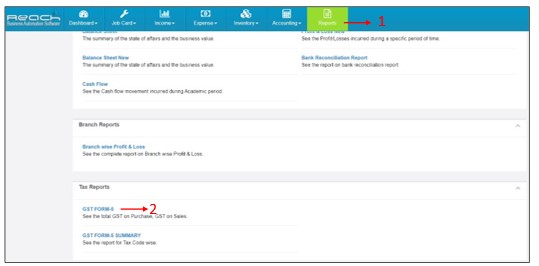

How to Generate GST report

Step 1 > Click on Reports

Step 2 > Click on GST FORM 5

Step 3 > Add GST Form.

Step 4 > Select the From Period and To Period

Step 5 > Click on Search

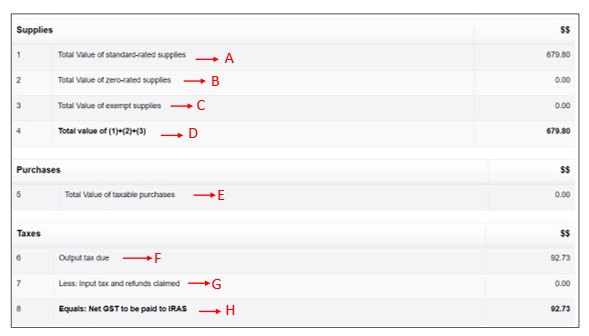

A – Box 1 refers to the value of the supplies (sales) which are subject to GST at the standard rate of 8%. The value you enter in this box should not include the GST amount charged.

B – Box 2 refers to Supplies of international services as listed in section 21(3) of GST Act.

C – A GST group can calculate its total value of exempt supplies for a prescribed accounting period by summing the value of each type of exempt supplies.

D – The amount in this box is your total supplies made for the accounting period. It will be automatically computed after you have filled in the amounts for box 1, box 2 and box 3.

E – Box 5 refers to the value of your standard-rated purchases (including imports) for which the GST incurred can be claimed, and zero-rated purchases. The value to be entered in Box 5 should exclude any GST amount.

F – The amount to fill in box 6 is the GST you have charged on your standard-rated supplies.

G – The amount you fill in box 7 includes: GST incurred for your purchases, subject to the conditions for claiming input tax.

H – The amount in this box 8 is the difference between box 6 (Output Tax Due) and box 7 (Input tax and refunds claimed). It will be automatically computed after you have filled in the amounts for box 6 and box 7. This box gives you the Net GST to be paid to IRAS.

Box 13 – The value of revenue earned can be extracted from the revenue items (e.g., sales) in your profit & loss accounts, whether they have been audited or not. As this value is based on your accounting treatment, it may be different from the amount declared in Box 4 which is your total supplies based on GST requirements. Revenue figure should be reported according to the prescribed accounting period covered in the GST return.

Finally Click on “Save”