Reports

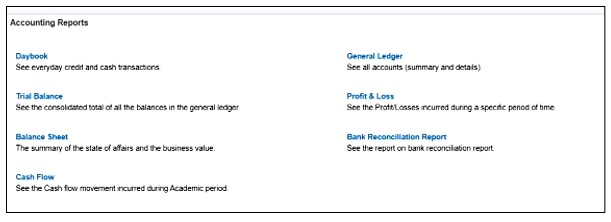

Accounting Reports

Accounting reports show the financial health of your business. Cash flow statements, profit and loss statements, and balance sheets are among the most popular types of accounting reports.

- Day Book – A daybook is a book of original entry in which an accountant records transactions by date, as they occur. This information is later transferred into a ledger, from which the information is summarized into a set of financial statements.

- Trial Balance – A trial balance is a financial report showing the closing balances of all accounts in the general ledger at a point in time.

- Balance Sheet – The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment.

- Cash Flow – A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows and outflows that a company receives from its ongoing operations and external investment sources.

- General Ledger – The General Ledger report is a record of your business’s financial transactions. It summarises all the chart of accounts of the business.

- Profit & Loss- A Profit & Loss statement shows a company’s revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. This report will be helpful to know the profit earned for a particular period.

- Bank Reconciliation Report – A bank reconciliation statement summarizes banking as well as comparing the bank’s account balance with internal financial records. Bank reconciliation statements confirm that payments have been processed and cash collections have been deposited into a bank account.